🥃🌿 The Gutter Report: Distillery vs. Dispensary — Why One Market Is Wide Open

Same vices. Same consumers. Very different barriers to entry.

🧠 What This Report Is About

This isn’t about culture wars, legalization politics, or lifestyle branding.

This is a business comparison between two regulated industries:

Alcohol (distilleries)

Cannabis (dispensaries)

Both sell controlled substances.

Both generate billions.

Both require compliance.

Where they are not comparable is startup cost, regulatory burden, capital required to enter, and how long ownership can realistically be maintained.

That difference explains why dispensaries appear more diverse, while distilleries — despite being easier to enter — remain overwhelmingly white-owned.

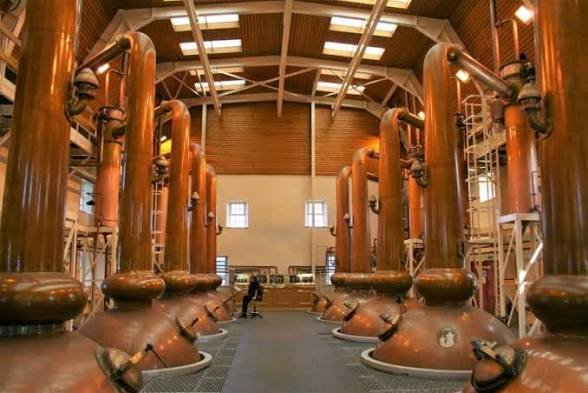

🥃 The Business of Distilleries (How Entry Actually Works)

Distilleries are manufacturing businesses, not retail-first operations.

To operate legally, you need:

a federal permit through the TTB

a state alcohol license

routine reporting and tax compliance

That’s the framework.

There are:

no numerical caps on licenses in most states

no requirement to open a storefront

no mandatory security infrastructure

no seed-to-sale tracking

Typical startup range: $50K–$250K, often less if starting extremely small.

In many states, distilleries can legally produce and sell wholesale before opening any tasting room. Retail, tourism, and hospitality are optional expansions — not prerequisites.

🏭 Fewer gates. Fewer permissions. Real ownership.

🥃 You can start here without a million dollars.

Distilleries are regulated, but the rules are clear, predictable, and linear. You execute, comply, and scale.

🌿 The Business of Dispensaries (Why Entry Is So Expensive)

Dispensaries are permission-based retail operations.

Before selling a single product, operators usually need:

state approval

local approval

compliant, zoned real estate

mandated security systems

compliance software

significant inventory capital

legal and consulting support

In many states, licenses are numerically capped, meaning even qualified applicants may never be approved.

Typical startup range: $250K–$1M+, with some states requiring proof of large liquid capital just to apply.

You can’t start small.

You can’t sell wholesale first.

You can’t avoid constant oversight.

🌿 Retail-first, capital-heavy, tightly controlled.

🔒 High regulation starts long before the sale.

Dispensaries don’t just regulate product — they regulate who is allowed to exist in the market.

📉 The Ownership Gap (What the Structure Explains)

Dispensaries appear more diverse because they are:

public-facing

retail-driven

highly visible

often tied to local representation

Distilleries don’t require visibility to operate.

They scale through:

production

distribution

wholesale contracts

tourism or hospitality later, if at all

That keeps ownership quieter and more insulated — favoring:

legacy capital

established distribution networks

early access to land and equipment

This isn’t about interest or talent.

It’s about which business model quietly rewards early control.

🏗️ The Gutter Business Take

If the goal is ownership — not hype, not branding, not visibility — distilleries make more sense right now than dispensaries.

Lower startup costs.

Fewer regulatory barriers.

No artificial license caps.

Ability to scale without retail exposure.

Ownership that lasts longer.

Cannabis is loud and crowded.

Distilling is quiet and still open.

The lack of Black ownership in distilleries isn’t because the door is closed.

It’s because most people are still focused on the louder room.

From a straight business perspective, more Black entrepreneurs should be studying distilling in 2026 — not as a trend, but as a controllable, survivable manufacturing business.

That’s the play.

Not for clicks — for clarity.

— Elliott Carterr, LFTG Radio

📱 TikTok: @elliott_carterr ↗

📺 YouTube: @lftgradio ↗

🌐 Website: LFTGRadio.com ↗

⚖️ The Gutter Justice Project ↗

❤️ Support the work: LFTGRadio.com/donate ↗